July 8, 2005

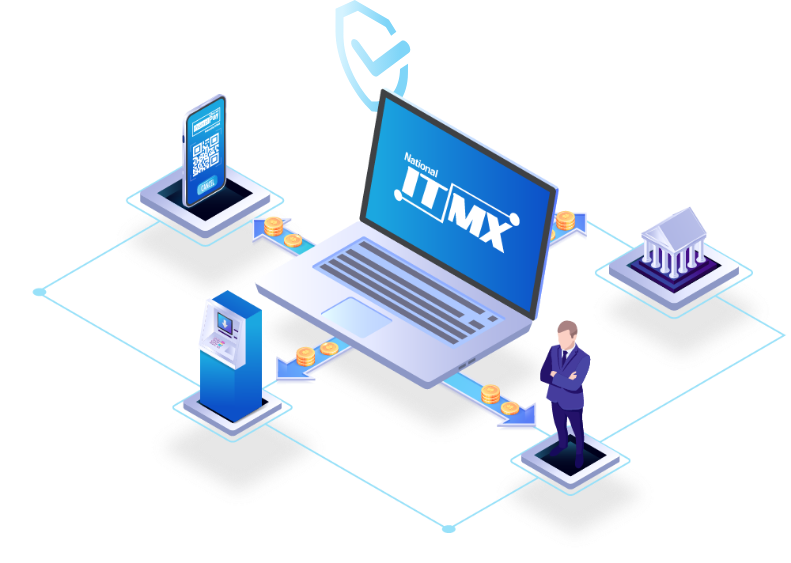

Changed Name to

National ITMX

National ITMX Company Limited changed its name from ATM Pool Company Limited.

The company aims to broaden its business scope and provide more diverse services, all while supporting the advancements and rapid changes in the e-Commerce business and online financial transactions made through various electronic media at both the domestic and international levels.

2005 - 2016

The Company established

ITMX system (Interbank Transaction Management and Exchange)

The company was established through the collaboration of Thai commercial banks in response to the policy of the Payment System Committee (PSC), in accordance with the Bank of Thailand's objective of reducing payment system costs and increasing linkages between various payment services in order to maximize services efficiency and security.

January 27, 2017

Officially launched

PromptPay

The Ministry of Finance, Bank of Thailand, and Thai Bankers' Association officially launched "PromptPay" service

PromptPay is an alternative service that allows transferring and receiving money using mobile phone numbers and/or identity numbers as an alternative to account numbers.

November 17, 2017

First introduced PromptPay service for

Funds Transfer between Banks

The company first introduced PromptPay service for funds transfer between banks that has been provided to member banks since then.

June 2017

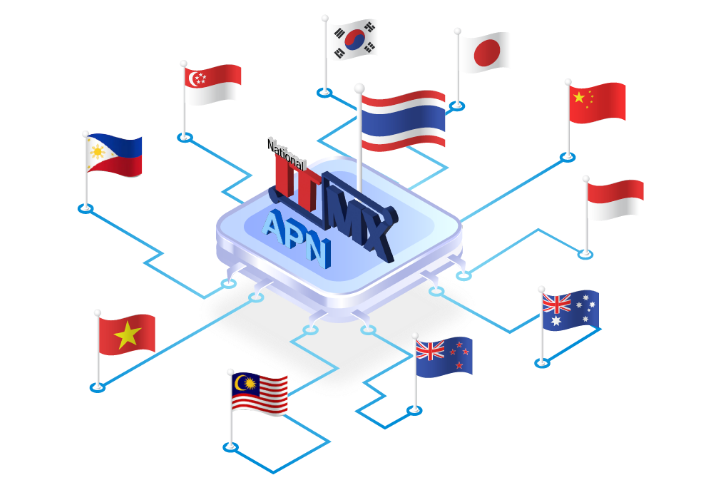

National ITMX was chosen as

APN Hub

The company was chosen by Asian Payment Network (APN) members to be APN Hub

March 7, 2018

Started providing PromptPay for

Billing to Member Banks

The company started providing PromptPay for billing to member banks. PromptPay billing services is an extension service of the PromptPay system infrastructure that allows retailers and businesses to send billing requests to buyers or users via messaging.

October 5, 2019

Launched

MyPromptQR

The company launched MyPromptQR, a new PromptPay system that enables retailers to scan the QR codes of their customers. Introduced to member banks. The new type of PromptPay service provided under the ISO20022 standard

December 2019

Started providing

Cross-Border QR Payment

Cross-Border QR Payment through mobile banking has been operational. Customers can scan QR codes of overseas retailers to boost the convenience of both customers and retailers.

November 13, 2020

Started providing PromptPay for

Cross-Border Bill Payment via QR Code

The company started providing PromptPay for cross-border bill payment via QR code, having Japan as a pioneering destination. Introduced to member banks.

January 18, 2021

Launched

Bulk Payment Service

The company developed and launched a new Bulk Payment service to member banks. In response to business sector demands and to support governance transactions.

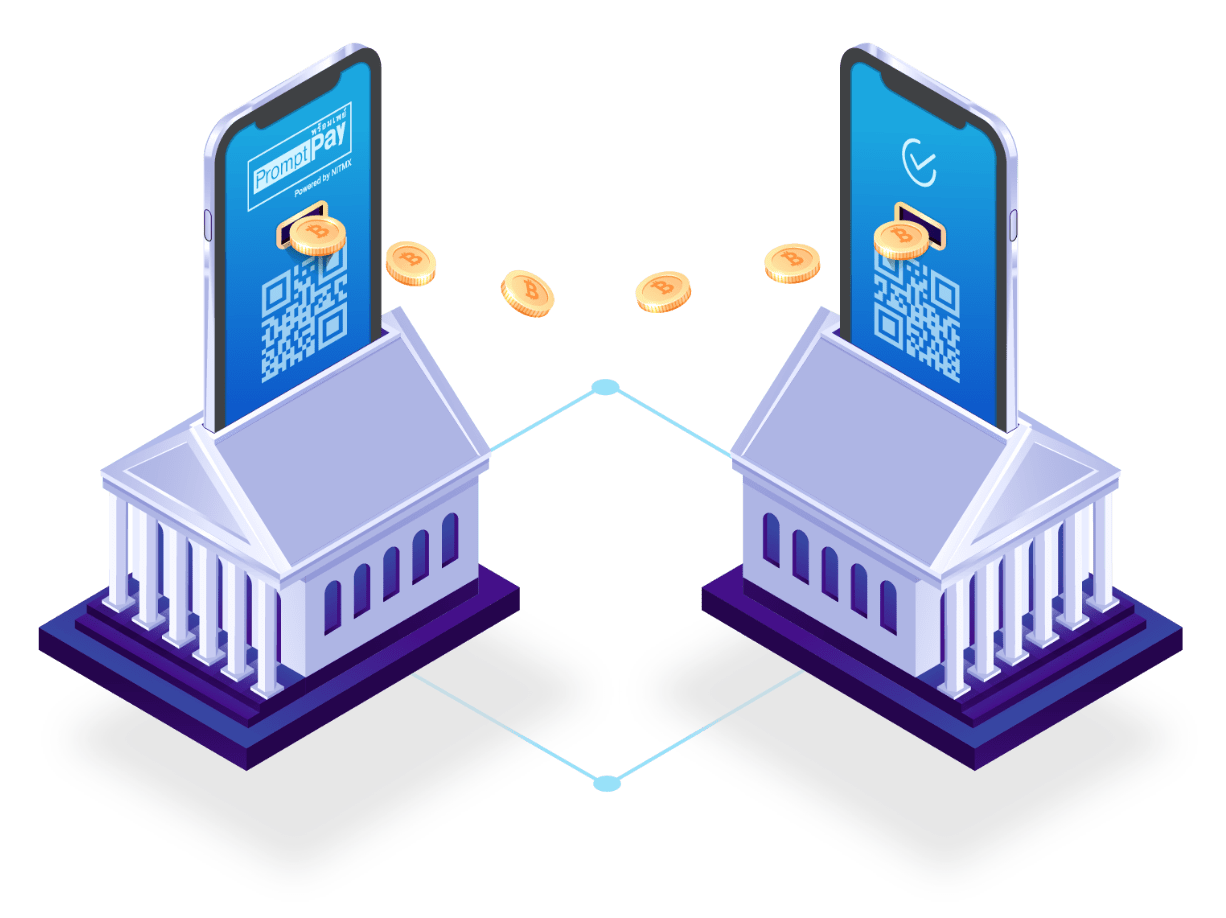

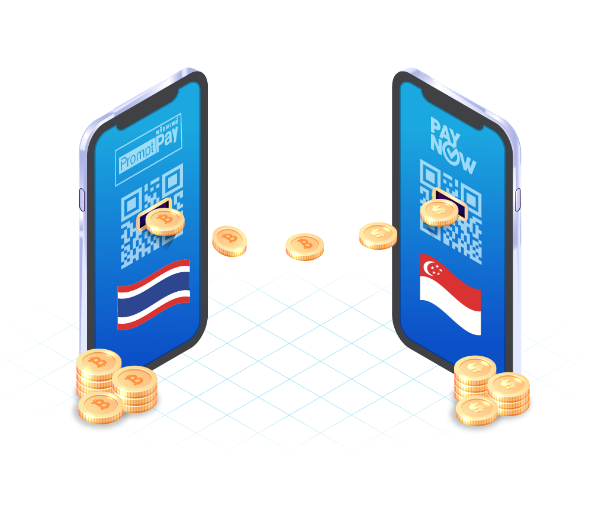

April 29, 2021

Launched the world's first system linkage of real-time fund transfer services between two countries

PromptPay - Paynow

The company launched the world's first system linkage of real-time fund transfer services between two countries, PromptPay and PayNow. Through a collaboration between the Bank of Thailand (BOT) and the Monetary Authority of Singapore (MAS),

April 2021

Started providing

Cross-Border Remittance

The company started providing Cross-Border Remittance Service. The service has enabled instant funds transfers between participating countries via mobile banking of participating banks using mobile phone numbers.

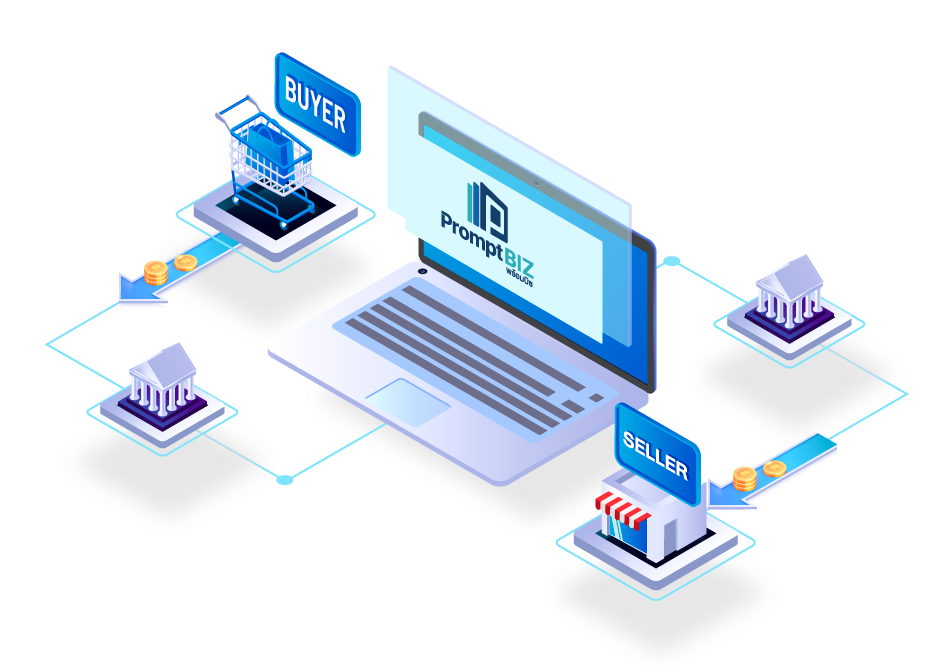

December 15, 2021

Started providing

Digital Supplychain Finance

The company started providing Digital Supplychain Finance system. The service helps SMEs to more easily access loans from financial sources through the new infrastructure, PromptBiz,

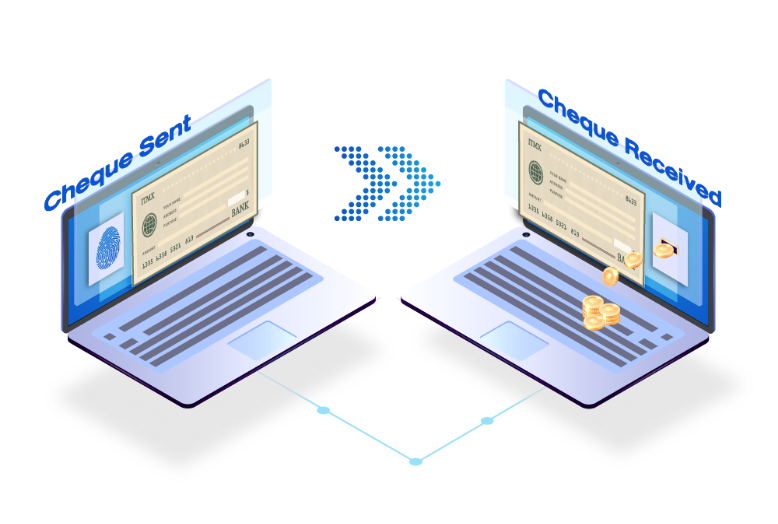

July 15, 2022

Transfer of ICAS service from BOT to

the ITMX system.

The company develops operational systems to support the transfer of ICAS service from BOT to the ITMX system. In response to BOT policy, various banking associations (including TBA, AIB, and GFA) agreed to the development of the Imaged Cheque Clearing System (ICS) currently under BOT to be operated on the ITMX system. The ICS service has launched on July 15, 2022.

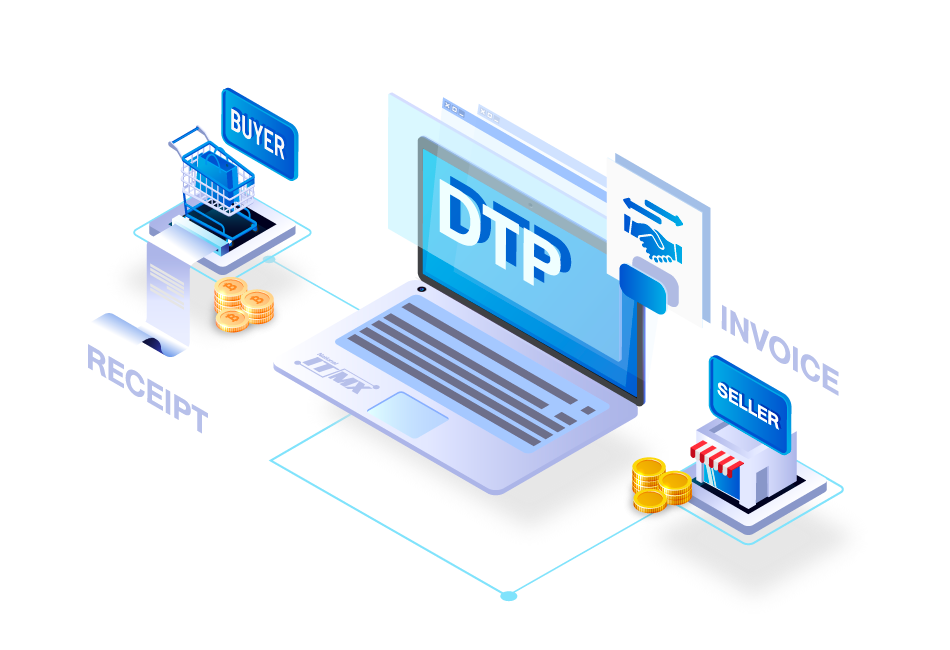

August 29, 2023

Started providing

Digital Trade and Payment (DTP)

The Company has launched the Digital Trade and Payment (DTP) service, which serves as a central platform for sending and receiving electronic invoices and e-tax invoices, as well as exchanging payment information with electronic receipts under the PromptBiz system.

November 27, 2023

Started providing

Cross Border QR Payment Thailand Hong Kong

The Company has launched the Cross-Border QR Payment service between Thailand and Hong Kong to support C Scan B cross-border payment transactions. This service enables convenient, fast, and secure payments between the two countries at participating merchants.

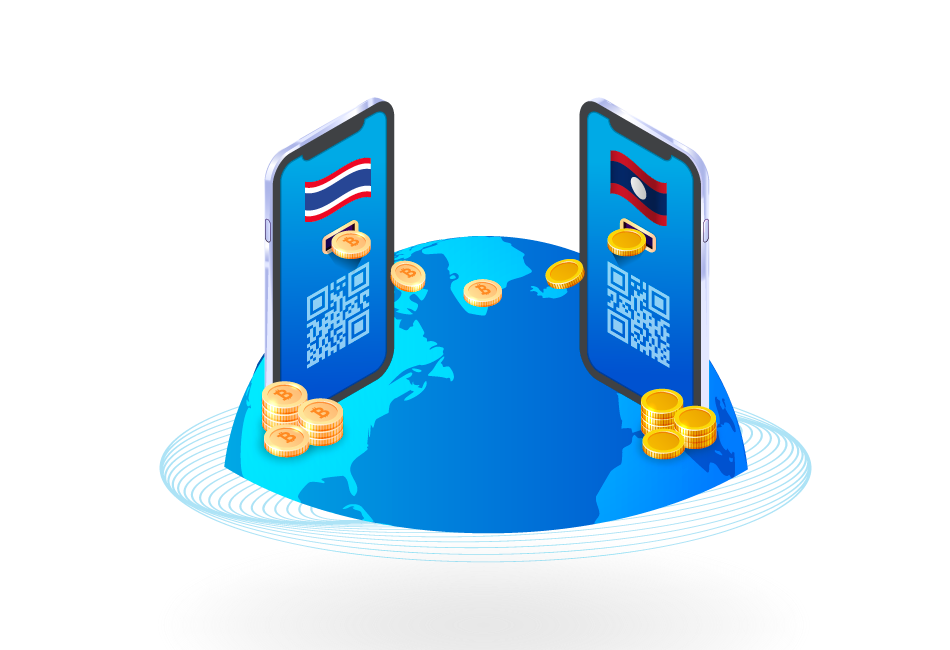

April 3, 2024

Started providing

Cross Border QR Payment Thailand Laos

The Company has launched the Cross-Border QR Payment service between Thailand and Laos to support C Scan B cross-border payment transactions via QR codes. This service enables convenient, fast, and secure payment transactions between the two countries at participating merchants.

November 21, 2024

Improved the financial transaction messaging system

PromptPay ISO 20022 C Scan B Migration

The Company has successfully improved and developed the financial transaction message sending and receiving system using the ISO 20022 messaging standard for the PromptPay C Scan B service, specifically in the areas of Service Banks and merchants, to enhance service quality.